If you’re new to the banking system and getting loans, you may be forgiven for thinking a bank’s main duty is money management. But, this is actually a very small part of what a bank does.

A big part of how a bank makes its money is through loans. This is particularly true for smaller banks. They offer out a number of loans to people who may want or need more money for a variety of things. They then charge an interest rate when you pay the loan back.

These interest rates can vary largely from bank to bank and for different loans. This is not only where the profit motive comes in, but also the risk management motive.

You see, banks can’t make profit on a loan that someone doesn’t pay back. For this reason, they are usually careful about who they loan to. Usually.

Loans can come in many shapes and sizes. Most people don’t consider credit cards or overdrafts as “loans,” but rest assured, that’s what they are.

Because of this, we put together a list of different types of loans you can get. We discuss which ones are best used for different people and purposes. Hopefully, this will help inform you and ensure you make a better choice the next time you’re looking for a loan.

Table of Contents

5 Kinds Of Loans And How They Work

Conventional loans

These are the types of loans you most likely heard you’re friends or parents complain about growing up. They include:

- Mortgages

- Car loans or other vehicle loans

These loans are not secured by the government. This means that if you can’t pay it back, the government won’t foot the bill like with some loans. Here, the bank takes all the risk. So, naturally the interest rate and difficulty in getting these loans can be high.

For Americans, there are both conforming loans and non-conforming conventional loans. The former follow guidelines by the Freddie Mac and Fannie May organizations. This means they’ll usually take into account the value of what your buying, your income-debt ratio, and your credit history.

The latter don’t follow these guidelines and go by their own individual framework.

Secured loans

These loans are backed by the person getting the loan. This can be done by securing the loan with your house, known as refinancing your home or remortgaging. This means that the bank can claim your home, or another item, if you’re unable to repay your loan.

Meanwhile, title loans are loans that secure a loan with your car. As with the above loan, you can also refinance this type of loan once paid off initially. These types of loans often have lower interest rates and can be very quick to get. You can also easily learn more about refinancing title loans or remortgaging online.

Unsecured loans

As the name implies, these loans have none of the lendee’s assets (things of value like cars, houses, etc.) backing them. As such, banks will usually base whether they’ll give you this type of loan on your credit history and income. They also usually have high interest rates.

Examples of these types of loans include:

- Personal loans

Open-ended loans

These are some of the more unconventional loans that you may not consider to be an actual “loan.” These can include:

- Overdrafts

- Credit cards

- Some payday loans

These loans are constantly available up to limit. Once paid off they can also immediately be used again.

While these loans can be convenient and help you repair your credit, their interest can often go unnoticed when looking at your finances. So, to get a full picture of your finances, be sure to check which of these loans may be a convenient alternative to a normal loan, and which may be an unnecessary expense.

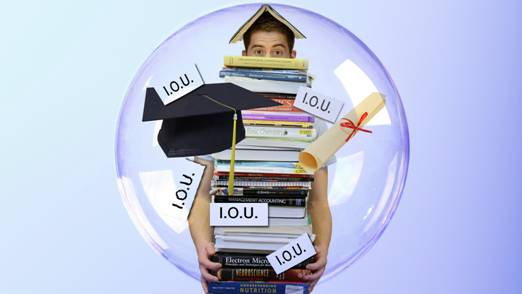

Student loans

These loans deserve special mention, particularly for younger people looking to lend. This is because there are two types of these loans.

One is private loans, which are like unsecured loan, but usually with higher interest than a personal loan. The other is a federal student loan, which is guaranteed by the government. The federal loan naturally has a lower interest rate.

But, one big difference here is that these loans are very difficult to default on. Not even if you declare bankruptcy. They can also take a long time to pay off due to high college fees and interest. So, be cautious with these types of loans and sure you can pay them off successfully.

The Bottom Line

There are a few loans that banks are less cautious about. Which means you should be more cautious about them. The reason for their lack of care is normally because they are sure they will get their money back.

It can also sometimes be difficult to find out which loan is best for you. This is because many banks may not advise you in your best interest. Remember, they are looking to make a profit. So, the higher the interest rate you have to pay is, the more profit they make.

Take these tips into consideration when taking out loans. You will be glad you were smart about it in the long run.